About Mint

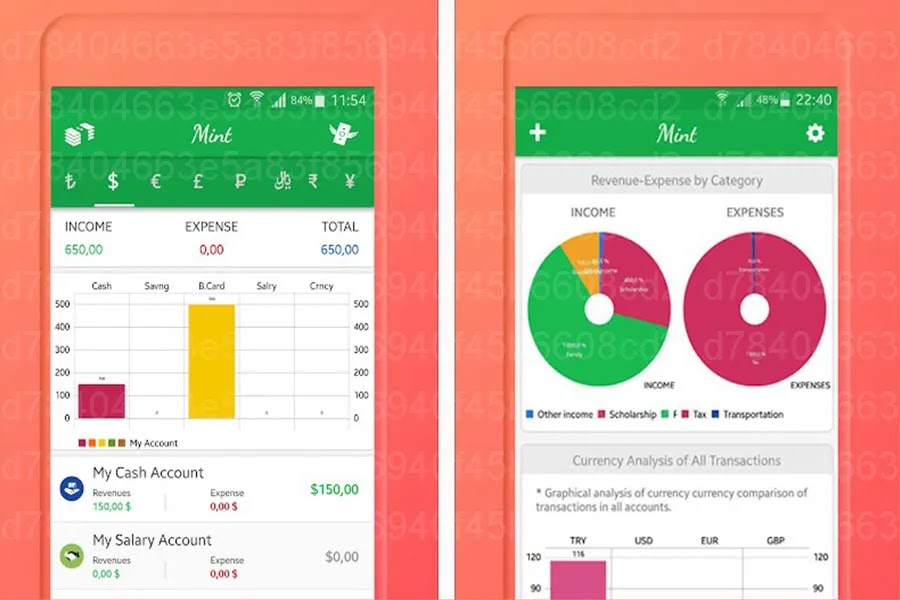

Mint is one of the leading personal finance apps available today, allowing users to track spending, create budgets, and check credit scores automatically. The app can integrate with bank accounts, credit cards, and investment accounts, giving you a comprehensive view of your finances.

The purpose of this article is to help you optimize your use of Mint to manage your personal finances more effectively, from tracking daily spending to planning long-term savings. The tips and tricks below will help you get the most out of Mint’s features.

Step 1: Connect Financial Accounts to Mint

To get started, it’s important to connect all your financial accounts to Mint. This makes it easy for you to track all your transactions and personal finances automatically.

How To Do It

- Open the Mint app and log in to your account.

- Select “Add Account” to add financial accounts such as banks, credit cards, investment accounts or loans.

- Enter login information for each account so Mint can sync and automatically track transactions.

Mint automatically updates transactions from all your accounts, helping you track your spending without having to do manual data entry.

Step 2: Classify Expenses Correctly

One of the powerful features of Mint is the ability to automatically categorize transactions into categories like dining, entertainment, shopping, bills, etc. However, you need to ensure that the transactions are categorized Accurate categories to be able to analyze spending effectively.

How to Check and Adjust Transaction Classification

- Go to the “Transactions” section in the Mint app.

- Check each transaction to see if they have been classified correctly.

- If adjustments are needed, tap the transaction and select a more appropriate category from the list of options.

Accurately classifying transactions will help you clearly understand your main expenses and easily adjust your personal financial plan.

Step 3: Create a Budget for Major Expenditure Categories

Mint allows you to create a budget for each spending category, helping you track the amount of money you spend and compare it to your set monthly budget. This helps keep you from going over your spending limit.

How to Create a Budget

- Go to the “Budgets” section in Mint.

- Select “Create a Budget” to start creating a budget for each spending category.

- Set the amount you want to spend in each category, for example dining, shopping or entertainment.

- Mint automatically tracks your spending and warns you when you’re close to going over your budget.

By setting a specific budget, you can control your spending more effectively and save for your long-term financial goals.

Step 4: Set a Savings Goal

Mint not only helps you track your spending but also assists you in setting savings goals. You can set savings goals for big plans like buying a house, retirement, or a trip. Mint will help you track your progress toward that goal.

How to Set Savings Goals

- Access the “Goals” section in Mint.

- Select “Create a Goal” and enter information about your savings goal (for example, save 200 million for a house within 5 years).

- Mint will help you calculate how much you need to save each month to reach your goal.

Having specific goals helps you stay motivated to save and track progress in detail, ensuring you’re on track.

Step 5: Check Your Credit Score for Free

Mint offers a free credit check feature to users, helping you monitor your credit situation and improve your score. This is especially useful when you plan to take out a home loan or open a new credit card.

How to Check Your Credit Score

- Go to the “Credit Score” section in Mint.

- Mint will display your current credit score along with the factors that affect it.

- Track your credit score and get suggestions to improve it if needed.

Regularly monitoring your credit score helps you be proactive in managing your personal credit and achieving the best conditions for future loans or credit cards.

Step 6: Receive Financial Alerts and Alerts

Mint provides financial notifications and alerts, helping you avoid missing payments or notifications when you go over budget. This is a very useful feature for managing daily finances without having to track too many details.

How to Set Up Notifications

- Go to “Settings” in Mint and select “Notifications”.

- Turn on notifications such as bill reminders, warnings when budget is exceeded, or when there are unusual transactions.

Mint will send notifications via email or text message, helping you easily manage your finances without missing any important information.

Mint Optimization Tips

- Use Power-Ups: Combine Mint with other tools like Google Calendar to manage your finances with your personal schedule.

- Update account information regularly: Make sure you have all your accounts connected and update your information regularly to get the most accurate view of your personal finances.

- Track daily transactions: Check daily transactions to ensure that no unexpected or erroneous expenditures have occurred.

Personal financial management

Using Mint to manage your personal finances is a great way to track spending, create a budget, and achieve long-term financial goals. With the ability to automatically track transactions, categorize spending and provide financial notifications, Mint helps you manage your money effectively without wasting too much time. By taking advantage of all of Mint’s features, you can optimize your personal finances and achieve financial stability with ease.